Paychex tax calculator

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Sign Up Today And Join The Team.

The Numbers And Nuances Involved In Calculating A Paycheck Paychex

ADP Salary Payroll Calculator.

. Over 900000 Businesses Utilize Our Fast Easy Payroll. Over 900000 Businesses Utilize Our Fast Easy Payroll. Sign Up Today And Join The Team.

That means that your net pay will be 40568 per year or 3381 per month. So your big Texas paycheck may take a hit when your property taxes come due. One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. The state tax year is also 12 months but it differs from state to state. Some states follow the federal tax.

Use the below paycheck calculators to learn more about your pay and taxes based on information you provide. Heres a step-by-step guide to walk you through. Your average tax rate is.

The Form W4 determines how much tax is withheld from your paycheck. How You Can Affect Your Texas Paycheck. Para garantizar que brindemos la información más actualizada y de mayor precisión algunos.

It can also be used to help fill steps 3 and 4 of a W-4 form. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Add your state federal state and.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Federal Salary Paycheck Calculator. Learn About Payroll Tax Systems.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. By accurately inputting federal withholdings allowances and any relevant. Important note on the salary paycheck calculator.

Learn About Payroll Tax Systems. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. If you want to boost your paycheck rather than find tax.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Paychex tiene el compromiso de brindar recursos para la comunidad hispanohablante. Free salary hourly and more paycheck calculators.

Expecting Gains In Paychex Stock Ahead Of Earnings

Should You Book Profits In Paychex Stock Now Or Wait

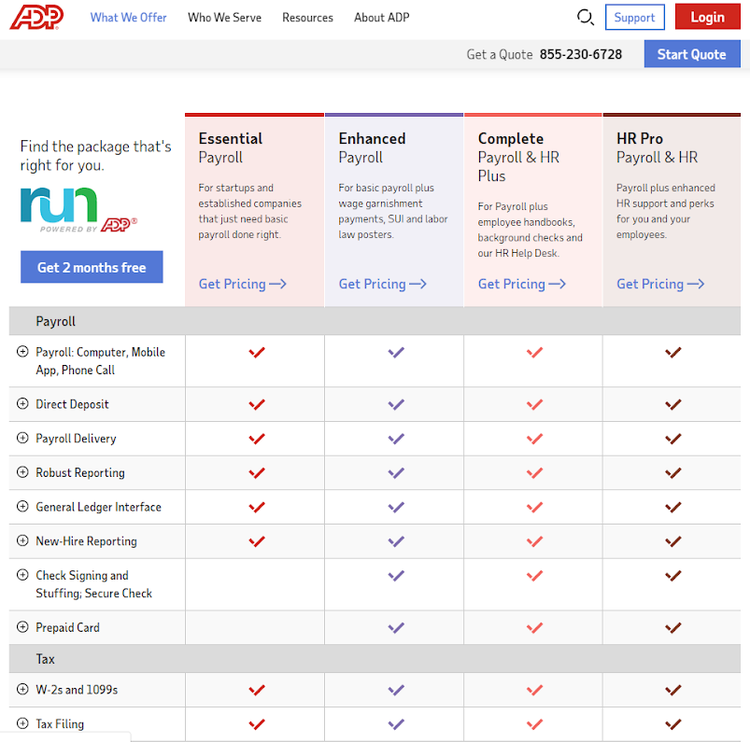

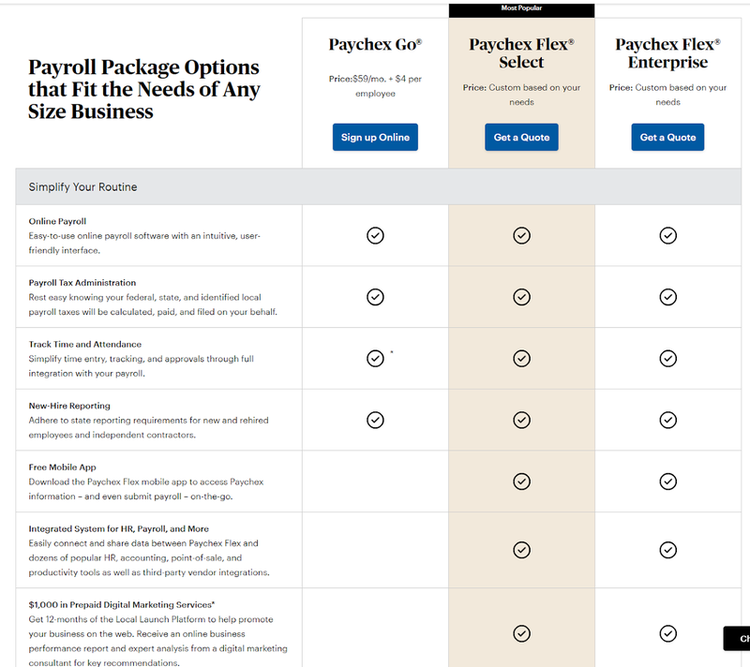

Adp Vs Paychex Which Is Better For 2022

Should Bears Rule Paychex Stock

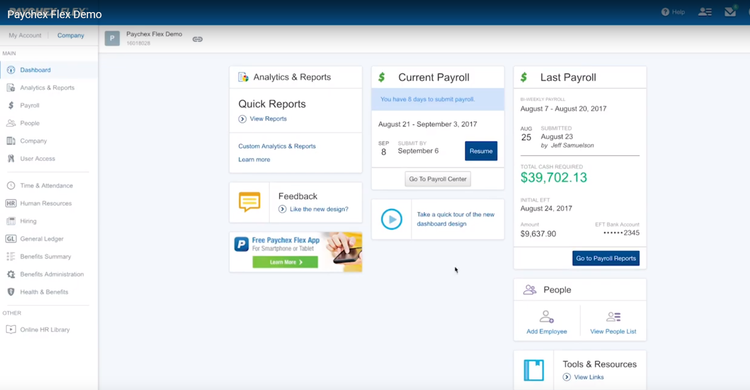

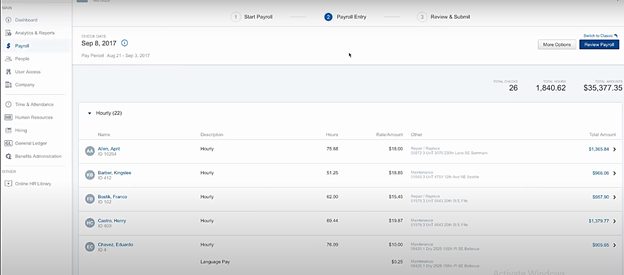

Paychex Flex Demos Paychex

Paychex Flex Hr Software Review 2022 Businessnewsdaily Com

Paychex Flex Demos Paychex

Paychex Inc Re Max Resources

Paychex Flex Demos Paychex

Paychex Flex Demos Paychex

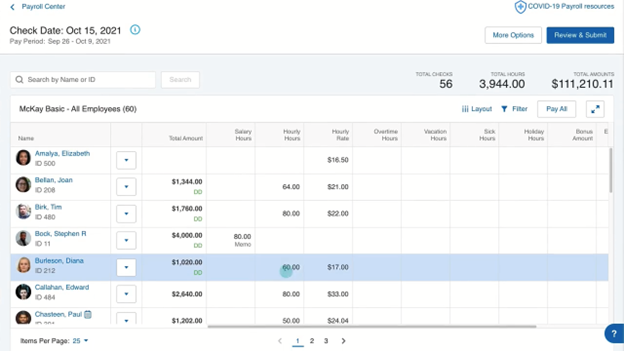

Adp Vs Paychex Which Is Better For 2022

Best Payroll Apps For Iphone And Ipad Igeeksblog

Paychex Flex Demos Paychex

Paychex Pricing And Fees 2022 Guide Forbes Advisor

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Adp Vs Paychex Which Is Better For 2022

Gusto Vs Paychex 2022 Which Should You Choose The Digital Merchant